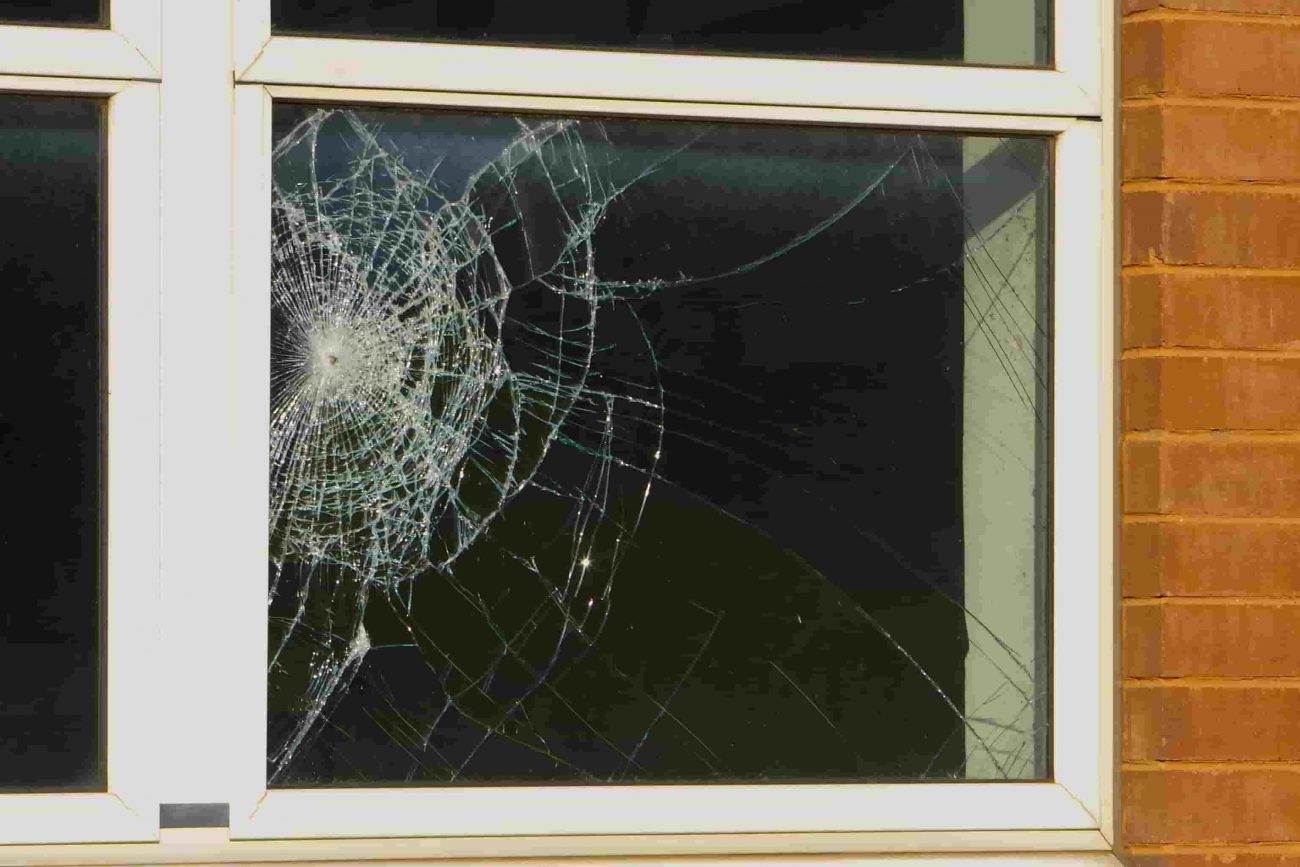

So, picture this: you’re driving along, minding your own business, when suddenly, you hear a loud “CRACK” from your windshield. You look up to see a small crack starting to spread across the glass. Panic sets in as you wonder, “Is this covered by insurance?” We’ve all been there, questioning what exactly is covered by our insurance policies. In this article, we’ll shed some light on the topic and help you navigate the crack in the window dilemma.

This image is property of www.championautoglass.com.au.

Understanding Insurance Coverage for Window Crack

When it comes to window cracks, insurance coverage can be a bit confusing. Homeowner’s insurance and auto insurance may provide coverage, but it’s important to understand the types of coverage available, the factors that can affect coverage, and any exceptions that may apply.

Types of Insurance Coverage for Window Crack

There are two main types of insurance coverage that may apply to window cracks: homeowner’s insurance and auto insurance. Let’s take a closer look at each type and what they typically cover.

Homeowner’s Insurance

Homeowner’s insurance is designed to protect your home and its contents from a variety of risks, including damage to windows. Here, we’ll delve into the coverage provided by homeowner’s insurance for window cracks, as well as deductibles and limits that may apply.

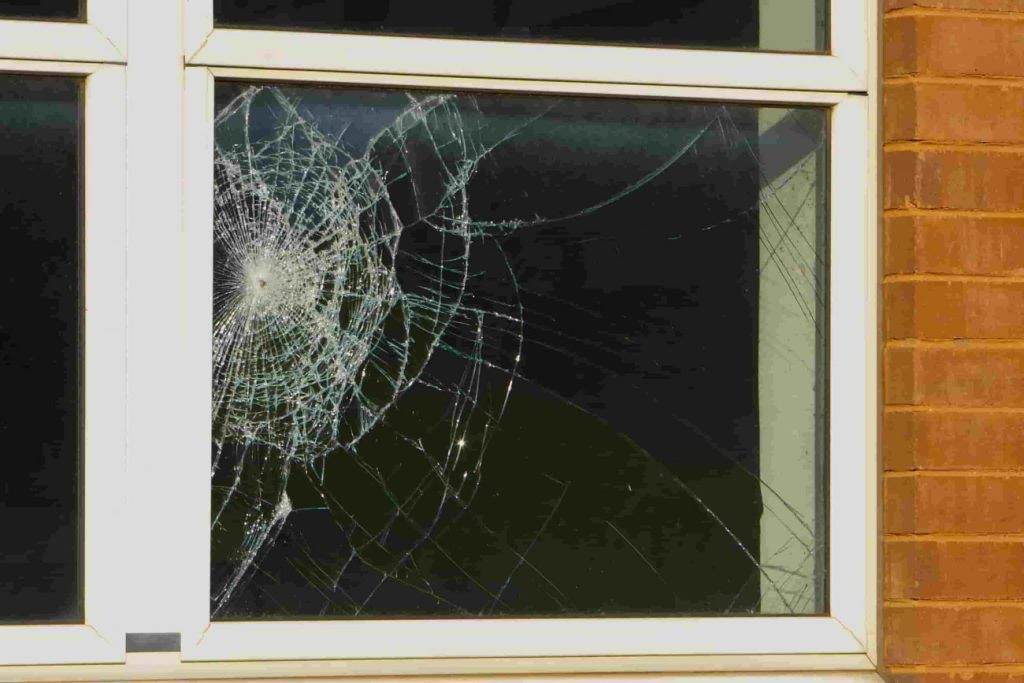

Coverage for Window Crack

Most homeowner’s insurance policies provide coverage for accidental damage, which includes window cracks. Accidental damage coverage typically covers unexpected events that result in damage to your property, such as a baseball accidentally hitting your window and causing a crack. However, it’s important to review your specific policy to understand the extent of coverage provided and any exclusions that may apply.

This image is property of www.britanniaglass.co.uk.

Deductibles and Limits

When it comes to homeowner’s insurance, there are usually deductibles and limits that apply to window crack coverage. A deductible is the amount you’ll need to pay out of pocket before your insurance coverage kicks in. For example, if your policy has a $500 deductible and your window crack repair costs $800, you’ll be responsible for paying the first $500, and your insurance will cover the remaining $300. Additionally, there may be coverage limits that determine the maximum amount your insurance company will pay for window crack repairs. Be sure to review your policy to understand these details.

Accidental Damage Coverage

Accidental damage coverage is a key component of homeowner’s insurance and typically protects against unexpected events that cause damage to your property. Let’s dive deeper into what accidental damage coverage entails and how it covers window cracks.

This image is property of www.theaa.com.

What is Accidental Damage Coverage?

Accidental damage coverage is designed to protect your property from sudden and unforeseen events, such as accidental breakage of windows. It provides coverage for repairs or replacements needed due to accidental damage. Window cracks caused by accidents, like a flying baseball or a fallen tree branch, would generally fall under the umbrella of accidental damage.

How Does it Cover Window Crack?

If you have accidental damage coverage as part of your homeowner’s insurance policy, it should cover the repair or replacement of a cracked window caused by an accident. However, it’s important to note that there may be limitations or exclusions listed in your policy, so it’s always recommended to review the terms and conditions carefully.

This image is property of d2yrzan8q3e3gn.cloudfront.net.

Named Perils Coverage

In addition to accidental damage coverage, some homeowner’s insurance policies offer named perils coverage. This type of coverage specifically lists the perils or events that are covered. Let’s explore what named perils coverage means and how it relates to window crack incidents.

Understanding Named Perils Coverage

Named perils coverage is a type of insurance coverage that specifically lists the perils or events that are covered. These named perils can include things like fire, vandalism, or theft. If your homeowner’s insurance policy includes named perils coverage, it may cover window cracks caused by any of the listed perils.

This image is property of hips.hearstapps.com.

Common Perils Covered by Named Perils Coverage

The specific perils covered under named perils coverage can vary depending on your insurance policy. However, common perils that are often included are fire, thunderstorms, lightning, hail, explosions, riots, vandalism, and theft. If your window crack is a direct result of one of these perils, chances are it will be covered by your homeowner’s insurance policy, subject to deductibles and limits.

Deductibles and Limits

deductibles and coverage limits play a crucial role in insurance coverage for window cracks. Let’s take a closer look at how these factors impact the claim process and the amount of coverage you may receive.

The Role of Deductibles in Insurance Coverage for Window Crack

As mentioned earlier, a deductible is the amount you’ll need to pay out of pocket before your insurance coverage comes into effect. higher deductibles often correspond to lower insurance premiums, while lower deductibles mean higher premiums. When it comes to window crack claims, it’s important to consider the deductible amount and ensure that the repair or replacement costs are higher than the deductible in order to make a claim.

Coverage Limits and Claim Process

Insurance policies typically have coverage limits, which specify the maximum amount the insurance company will pay for a particular claim. When it comes to window cracks, it’s essential to understand the coverage limits outlined in your policy. If the cost of repair or replacement exceeds the coverage limit, you may be responsible for covering the remaining expenses. Additionally, every insurance company has its own claim process that needs to be followed when filing a claim for a window crack. Make sure to acquaint yourself with the process and provide all necessary documentation to support your claim.

Auto Insurance

If a window crack occurs in your vehicle, auto insurance may come into play. Let’s explore the coverage options typically provided by auto insurance policies for window cracks.

Coverage for Window Crack

auto insurance policies typically include coverage for window cracks under two main categories: collision coverage and comprehensive coverage. Understanding the specifics of each coverage type is essential for determining the extent of coverage available for window cracks.

Collision Coverage

Collision coverage in auto insurance is specifically designed to cover damages caused by collisions with other vehicles or objects. If a window crack occurs as a result of a car accident or collision, collision coverage may apply and provide coverage for repair or replacement.

Comprehensive Coverage

Comprehensive coverage, also known as “other than collision” coverage, covers damages to your vehicle that are not caused by a collision. This includes incidents such as theft, vandalism, fire, or falling objects. If your window crack is caused by a covered incident other than a collision, comprehensive coverage may provide the necessary coverage for repair or replacement.

Factors Affecting Insurance Coverage for Window Crack

While insurance coverage for window cracks can be beneficial, several factors may influence the availability and extent of coverage. These factors include policy terms and conditions, insurance provider’s guidelines, and the age and condition of the window.

Policy Terms and Conditions

The terms and conditions of your insurance policy play a crucial role in determining the coverage provided for window cracks. It’s important to thoroughly review your policy document to understand any exclusions, limitations, or specifications related to window crack coverage. Some policies may have specific requirements, such as reporting the damage within a certain time frame or using approved repair providers, so be sure to follow these guidelines to ensure you are eligible for coverage.

Insurance Provider’s Guidelines

Each insurance provider may have its own guidelines regarding window crack coverage. These guidelines can vary depending on the provider’s assessment of risk and their policies regarding window-related claims. It’s advisable to contact your insurance company or review their documentation to understand their specific guidelines for window crack coverage.

Age and Condition of the Window

The age and condition of the window can also impact insurance coverage for window cracks. Older windows or windows in poor condition may be subject to additional scrutiny from insurance providers. Some policies may have limitations or exclusions based on the age or condition of the window, so it’s important to consider these factors when assessing your coverage options.

Steps to File an Insurance Claim for Window Crack

If you find yourself dealing with a window crack and you believe it may be covered by your insurance policy, here are some steps to follow to file a claim:

Reviewing the Insurance Policy

The first step is to carefully review your insurance policy to determine if window crack repairs are covered. Look for any exclusions, deductibles, or limits that may apply. Understanding your policy will help you navigate the claims process more effectively.

Documenting the Damage

Next, take photos or videos of the window crack and any surrounding damage. This documentation will serve as proof of the damage and help support your claim.

Contacting the Insurance Company

Contact your insurance company to report the window crack and initiate the claims process. Provide them with all the necessary information, including the date of the incident, a description of what happened, and any supporting documentation you have.

Coordinating Repairs

Once your claim has been approved, work with your insurance company and any repair providers they recommend to coordinate the repairs. Follow the guidelines provided by your insurance company to ensure a smooth repair process and to maximize your coverage benefits.

In conclusion, insurance coverage for window crack can vary depending on the type of insurance policy, the coverage options chosen, and various other factors. Understanding the coverage provided by homeowner’s insurance and auto insurance, as well as the factors that affect coverage, is crucial to ensure you are adequately protected. Remember to review your policy documents carefully, follow the claim process outlined by your insurance company, and be proactive in documenting and reporting any window crack incidents.